DoorDash가 티커대로 상방으로 DASH하고 있다.

(예전 분석 글도 참고)

24.3Q에는 흑자 전환까지 이뤄내며 파죽지세다.

아직까지 시총 대비 이익 규모가 의미있는 수준은 아니며(연환산 PER 100 수준),

플랫폼 사업 특성상 규모의 경제와 내러티브가 중요하기 때문에 재무지표는 간략하게 살펴보고,

DoorDash가 그리는 성장 내러티브를 보여주는 질의응답을 자세히 살펴보도록 하겠다.

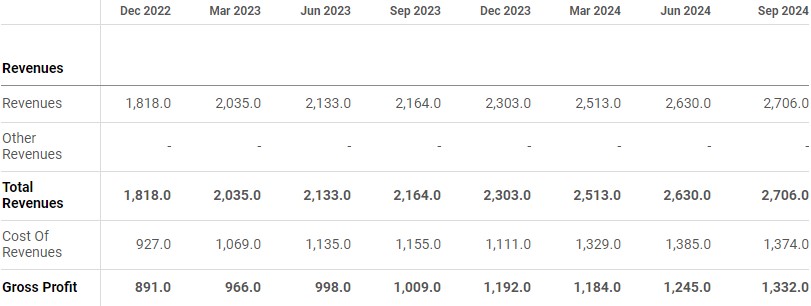

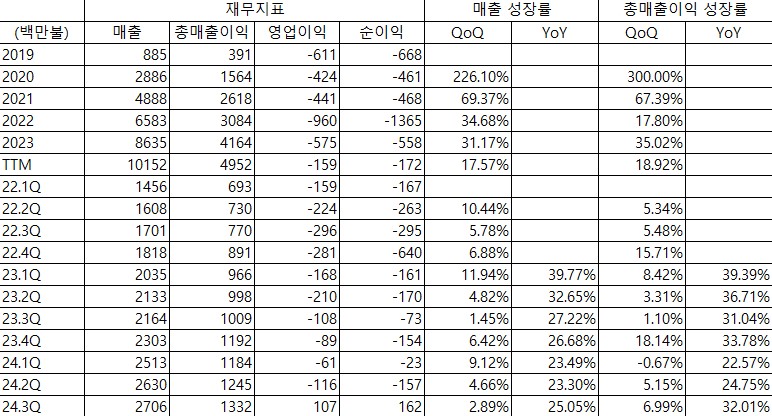

DoorDash 성장성을 보여주는 24.3Q 재무지표

24.3Q 흑자 전환, 성장 추이

미국 현지시각 10.30일 저녁(한국 시간 31일 새벽) DoorDash 24.3Q 실적이 발표되었다.

매출이든, 이익이든 정말 거침없는 성장세이다.

24.2Q YoY 성장률이 23.3%였는데, 24.3Q YoY 성장률은 25.0%로 더 기울기가 급해졌다.

(오른쪽으로 갈수록 최근 실적)

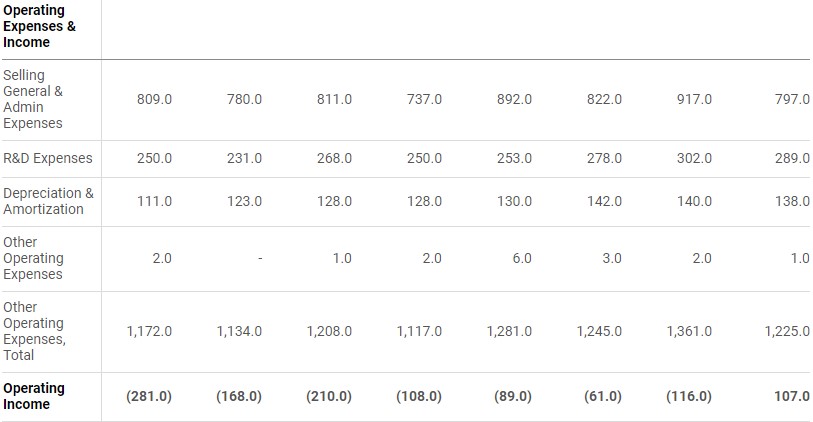

영업이익은 최초로 흑자로 전환하였다.

인상적인 것은 매출의 급증 가운데 원가가 감소하고 있다는 것이다.

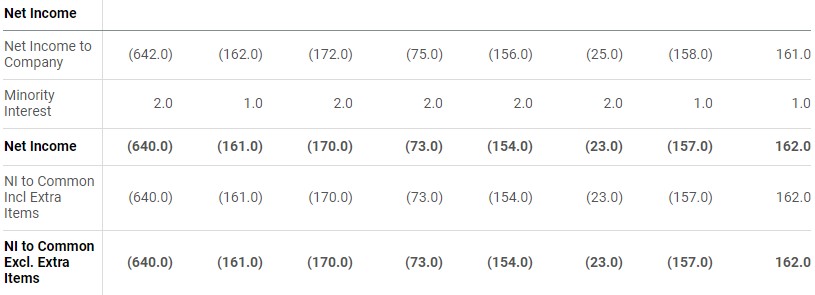

순이익 또한 흑자 전환하여 앞으로가 기대된다.

DoorDash – DoorDash Releases Third Quarter 2024 Financial Results

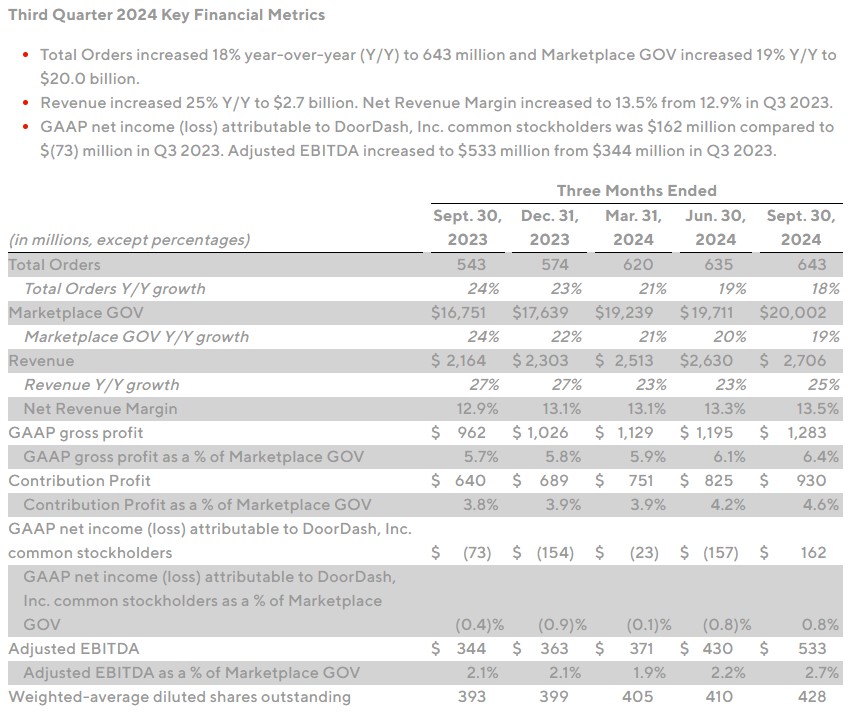

24.3Q 주문횟수는 6.43억회로 YoY +18%, 총주문액은 $200억(약 27조원)로 YoY +19%,

매출은 $27억(약 3.65조원)로 YoY +25%, 순이익은 $1.62억(약 2,187억원)로 흑자전환했다.

그간의 실적과 영업 레버리지 효과

그간의 실적을 살펴보면, 매 분기 매출과 총매출이익 성장을 이뤄왔으며, YoY 기준 성장률이 계속 20%를 초과해왔음을 확인할 수 있다.

그리고 긴 성장의 끝에 24.3Q에 드디어 영업이익과 순이익이 흑자전환했음을 확인할 수 있다.

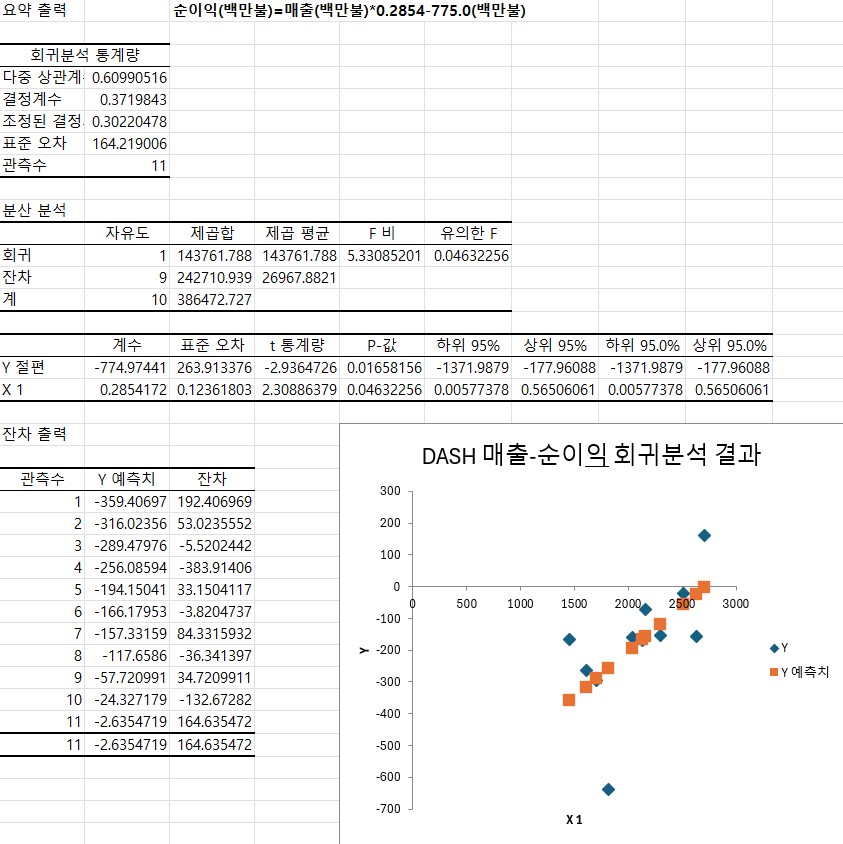

매출 성장에 따라 어떤 추이로 이익이 개선되는지 확인하기 위해 회귀분석을 해봤다.

순익(백만불)=매출*0.2854-775.0(백만불) 으로,

고정비는 7.75억불, 매출 성장시 장기 순이익률은 28.5% 수준에 수렴하게 될 것으로 예상되며,

YoY 성장세가 유지되면 25.3Q 순익은 2706*1.25*0.2854-775.0=190.4(백만불)로 예상된다.

자신감의 표현일까, 재무지표를 보도자료로 배포하고, 컨콜 시간을 모두 Q&A 세션으로 채웠다.

주요 질의 응답을 정리하여 DoorDash의 영업 현황을 파악해보도록 하겠다.

(내용을 정리하고 참고용으로 아래 영어 원문을 표시, 결론에 전체적인 내러티브 평가)

DoorDash 24.3Q 질의 응답

회사측 참가자 : Andy Hargreaves(IR 담당 부사장), Tony Xu(CEO), Ravi Inukonda(CFO)

Nikhil Devnani(Bernstein) : 해외사업 성장추이, 고정비 질의

미국 사업에서 소비자 집단이 서비스를 경험하고 3~4년이후 수익성이 개선되었는데,

해외사업도 유사한 추이인지, 아니면 시장 구조 등 원인으로 인해 다른지?

I wanted to ask a two-part question on international. So in the past, you’ve kind of illustrated this dynamic in the U.S. business where as cohorts experienced go forward and mature a little bit you see improvements in the contribution margins by years three and four. Now that you’ve been operating in some of these international markets for a few years now, have you seen a similar arc and magnitude of improvement on the contribution margin front for these cohorts as well? Or is it a little bit different for market structure reasons or for other reasons?

해외 사업 운영시 미국 사업에서의 기술과 인력은 공유할 수 있겠지만 배달은 매우 지역 기반 사업이라는 점을 고려할 때 해외 확장 과정에서 고정비 부담이 완화될 수 있는지?

And then my second question is around the degree of fixed cost leverage that you can get operating in so many different countries at once. I’m sure you get to share some technology and talent, but given delivery is hyper local, how do those two things shake out? Is your fixed cost burden in your newer markets lower and easier to overcome or not really? Thank you.

CEO : 미국 DoorDash와 유사한 추이로 점유율 확대,

시장/제품 추가시 같은 팀이 작업하여 확장 노하우 레버리지 발생

매출, 이익측면에서 미국과 해외 시장은 비슷하다.

Volt(DASH가 인수한 해외 배달사업 회사)와 처음 협업할 때 미국 사업과 유사한 유지율, 주문빈도 데이터를 볼 수 있었고, 효율적 성장 경로를 반복할 수 있다고 본다.

Hey, Nik, it’s Tony. I’ll start and Ravi feel free to chime in here. I think on your first question, in short, the answer is yes. We are seeing similar progress both top line and bottom line in our international markets that we saw, while building the U.S. And that’s because if we were to rewind the clock three years ago when we first partnered with Volt, what we saw in the company was something that looks very familiar to us at DoorDash, which is a company that has built the leading product when it came to retention and order frequency. And that really is what drives the flywheel in terms of efficient growth.

진출한 모든 시장에서 점유율과 수익이 올라가고 있다.

And so we continue to see this past quarter as well as in the last several years of partnering together with both continued strong progress, where we virtually are gaining share in every single market that we play in. and we continue to see the bottom line perform in tandem. And so you are seeing that progression, and it’s been very encouraging.

고정비와 관련된 두 번째 질문 관련, DoorDash는 후속 시장/제품을 추가할 때 동일한 팀이 작업을 진행하기 때문에 확장 노하우 측면에서 영업 레버리지가 발생한다.

I guess, I can start on the second question, and then I’ll hand the mic over to Ravi. In terms of fixed cost leverage, in short, the answer is yes. As we add subsequent markets or subsequent even products, we do use, I mean, for all intents and purposes the same team. You’re right to say that these are hyper local businesses and services. So we do have to obviously start new in terms of acquiring each of the different audiences.

But in terms of the tech stack, in terms of the products, in terms of the know-how whether that’s expanding products within a geography or adding net new geographies, you do see that operating leverage.

CFO : 경쟁사보다 빠른 성장, 규모의 경제 효과

해외사업은 24.3Q 뿐만 아니라 24년 동안 계속 성과가 좋았으며, 경쟁사들보다 빠르게 성장하여 모든 진출 시장에서 점유율을 확대했다.

Yes. Hey, Nick, let me add a couple of points there, right? Like when you think about the performance of the overall international business. I mean, it has a strong third quarter as well as the year itself has been very strong. When you think about it from a growth perspective, we are growing substantially faster than peers, which essentially means we’ve gained share in virtually most of the markets that we operate in.

24.2Q 총매출이익이 흑자이며, 24.3Q에도 그렇다.

규모의 경제가 작용하는 사업이며,

DASH는 유지율과 주문빈도를 높일 기회가 있으면 두 배로 투자한다는 원칙에 따라 경영해왔다.

Last call, if you recall, I mentioned the fact that the overall international business is gross profit positive. It continues to be the case. The dynamics are similar, right? Like this is a scale-driven business. Our goal has always been, if we find good opportunities to drive retention and order frequency, we’re going to double down and invest. That’s the same formula we are using in the international market. We are pleased that the gross profit continues to improve.

미국 사업과 마찬가지로 규모의 경제가 중요하며, 해외사업이 초기 단계라는 점을 고려했을 때 고정비 측면에서 유사한 추이를 보일 것으로 기대한다.

On the fixed cost, I mean, similar dynamics that we saw in the U.S. Again, a lot of it has to deal with scale. But if you recall where we are in the international markets, we are still very early. We’re investing behind product, and that’s what’s causing the strength that you’re seeing from a cohort retention and an order frequency perspective.

Michael Morton(Moffett Nathanson) : 식료품 성과, 이용자 특성

식료품 유통사들이 DASH 플랫폼에 접근하고 있는지? 식료품 분야 쇼핑 시간, 쇼핑 액수 등 추이를 공유해줄 수 있는지?

Hi, everyone. Thanks for the question. I wanted to start firstly maybe one for Tony, and then a cohort question for Ravi. It’s great to see the Wegmans grocery announcement. Just curious if we’re getting closer to seeing an unlock of some of the largest grocers in the country who are not currently on DoorDash platform coming on to DoorDash? And then on the grocery topic and thinking longer term and your ability to make strides into the market. Could you talk about the trends that you see for the grocers who have been on the platform for the like longer extended period of times that you see with larger baskets and maybe larger basket market share trends for the grocers have been on the platform for two years?

DASH 이용자 집단의 특성(연령대)에 대해 공유해줄 수 있는지?

And then for Ravi your comments on cohorts the last couple of quarters is really encouraging. The new cohorts coming in being as strong as ever. The question that we get from investors is, who are these people? What are the demographics isn’t everybody already ordering food and clearly not? So we would love if you could maybe shine a little light on what they look like. Is this skewing younger college age students, more digitally inclined, who are moving out of their home every fall going to college? Anything there would be great. Thanks again.

CEO : 수요 충족에 집중하여 이용자/주문량/빈도 증가

4년 전 자주 소비하는 품목, 주 중간에 소비되어 새로 구입이 필요한 식료품 구입 수요를 충족하기 위해 식료품 시장에 진출했다.

Hey, Michael, it’s Tony. Yes, on the first question related to grocery, we’re pretty excited about what we’re seeing in grocery. I mean, we launched grocery at this point almost four years ago now. And the entry point was by delivering a product that was relatively speaking, new to the market, which was solving for this top-up experience, where for consumers, we were replenishing that middle of the week run where you run out of the items that you consume the most often or the earliest or the ones that perish the most frequently, whether that’s your berries, your fruits, your dairy products, your coffees, et cetera.

새로운 카탈로그를 만들고, 수요 품목을 충분히 이해하여 이용자들이 이해하기 쉽고 기존 식료품점에서 할 수 없었던 것들을 가능하게 하는데 시간이 걸렸고, 아직도 해결이 필요한 문제이다.

And I think what that spurred was both an introduction that was easy to understand for consumers and also something that grocers hadn’t seen before and made it very easy to onboard a lot of these grocers. Now all of these things take time, right? I mean we had to build a new catalog from scratch. We obviously wanted to make progress on understanding inventory and the reliability of the inventory fees that we’re receiving, which we thought is one of the biggest problems to solve here.

DASH는 미국 최대 식료품점들을 포함하여 큰 진전을 이뤘고, Wegmans 뿐만 아니라 모든 식료품점 입점을 동등하게 반기고 있다.

And we’ve made tremendous progress pretty much across the Board, whether that’s adding selection, including some of the largest grocers in the country. We’re just as excited as you are about Wegmans, but also everyone else that whether that’s the corner grocery store to the middle market, grocery stores. And I think this is why you’re seeing, when it comes to customer adoption, customers come to DoorDash first, new customers into the grocery delivery industry. And just in general, to delivery outside of restaurants come to DoorDash first, before any other platform.

이용자들도 식료품을 DASH에서 사는데 익숙해지고 있으며, 점점 더 많이, 자주 사고 있다.

And so I think you’re already seeing a lot of this. And in terms of other trends, we see that as customers get used to ordering groceries on DoorDash, they tend to order more items each subsequent visit. So from a cohort perspective, you’re noticing that we are increasing both the frequency as well as the spend and wallet share in terms of how consumers spend when it comes to their monthly bills on grocery. And that’s increasing with every single cohort.

결국 초기 기대보다 더 시장이 커졌고, DASH는 신규 이용자 확보가 일어났는지, 점유율을 선도하고 있는지, 구매가 유지되는지, 경쟁기업을 따돌리고 있는지 모니터링하고 있다.

So in short, I think what we’ve seen is, we have seeing a much bigger market than we expected when it came to launching this pop-up run product, which now has nicely translated into shopping for the other types of occasions, including your weekly stock ups and those types of baskets. And we just continue to see whether it’s on the new customer acquisition side, leading share there. And then also on the retention side, positioning us to really continue to grow in a way that will outpace others as well as outpace our previous cohorts.

CFO : 기존 이용자, 식료품 신규 구매 등 이용자 증가 경로 다변화

대부분 고객은 기존(배달을 이용하던) 이용자로부터 나온다.

Hey, Mike, it’s Ravi. I’ll take the one on cohorts side? Maybe I’ll just level up and give you broadly on what we’re seeing from an underlying cohort perspective. I mean, you’re right, we’ve been very pleased with the cohorts. I think about it like a majority of the volume still comes from existing cohorts for us. The most instructive thing for me when we’re operating the business is to look at the engagement of the older cohorts.

하지만 5~7년 이상 된 이용자들도 유지되며 구매를 증가시키고 있다.

And if you look at the older cohort, even cohorts as old as five, six, seven years old, we’re still seeing good amount of retention as well as overall wallet share increase. And that tells you that the improvements we are making in the product, whether it’s selection, whether it’s adding new categories, all of that is driving the new, I mean, the cohort trend that you’re seeing in the business.

또한, DASH는 여전히 새로운 이용자를 유인하고 있으며, 연령대 측면에서도 그런데, 이는 DASH가 더 많은 선택지, 식료품 등을 추가하며 변하고 있기 때문이다.

From a new cohort perspective, I’ll have a couple of ways to think about this, right? One is we’re still attracting a healthy amount of new consumers. It’s not any different from a demographic perspective. We’re starting to see cohorts coming from some of the suburban markets still. And the reason for that is, remember, this is a product that continues to change. We add more selection, grocery, in many cases, the selection is net new to the platform.

또한 최근에는 식료품 구입으로도 이용자들이 유입되고 있다.

And the second way we are seeing is not only are consumers new to restaurants, today, we actually add consumers that start their journey with grocery as the first order. That’s a net new consumer that we’re adding to the platform. But overall, when I look at the underlying cohorts, I mean the strength continues to be very strong, both across existing as well as new.

Bernie McTernan(Needham & Company) : 타사 협업 전략

협업 전략은 어떻게 되는지?

Great. Thanks for taking questions. Just wanted to ask about the partnership strategy, especially in light of the list announcement from tonight. So maybe just talk about the broader partnership strategy. I know you also partner with streaming companies, for example, but is there anything different here with the list that there is the driver component as well?

CEO : 좋은 제품 제공을 통한 유기적 성장이 우선(80%),

협업도 좋은 고객 확대 기회(20%)

DASH가 가장 중요하게 생각하는 것은 상권을 활성화하는 것이다.

따라서 이용자들에게 선택권, 품질, 경제성, 서비스를 제공하기 위한 제품 구성을 중요하게(80%) 생각한다. 이런 노력이 있었기에 Dash 패스가 성공할 수 있었다.

Yes. Hey, Bernie, it’s Tony. Maybe I can take this one. So one of the things we have at DoorDash that we believe in and follow religiously, is that we keep the main thing, the main thing. And the main thing at DoorDash is building and enabling local commerce. And so when you think about kind of our perspective on all things, partnerships as well as building products, the 80 goes towards building products, which means that it’s because that we’ve offered customers the best combination of selection, quality, affordability and service that we get used the most often our app. And because we get used the most often, it’s how we actually are able to build not only the most useful, but also the largest local commerce membership program, which is Dash pass.

20%는 협업으로, DASH 네트워크 밖에서 이용자들에게 매력적인 혜택을 제공할 수 있는 기업들이 있다. Chase, MAX 등 회사와 협업을 발표했고 오늘 Lyft와의 협업 발표는 정말 기대된다.

Now that’s the 80. The 20 is the partnerships piece, where for us, we do believe that there are others outside of our network that can offer attractive benefits to our members. You saw this a few years ago when we first launched our partnership with Chase, which we renewed in an expanded way earlier this year. Then you saw the announcement and partnership with MAX, which happened a couple of months ago in terms of adding streaming benefits to DashPass subscribers. And then today’s announcement with Lyft, which we’re really excited about.

Lyft는 수백만 라이더가 이용하는 서비스이며, 다수는 이미 DASH의 고객이다. 많은 사람이 추가로 DashPass 회원 가입할 기회라고 생각하며, Lyft 입장에서도 가장 큰 지역 상거래 플랫폼에 접근할 수 있게 되어 매력적인 협업 기회이다.

Lyft is a service that’s used by millions of riders. And many of those riders already are DoorDash customers. Some of them are DashPass subscribers, but a lot of them are also not DashPass subscribers. And so I think it’s a great opportunity for us to continue to add engagement to the DashPass program as well as new DashPass members. And in return, lift gets access to the largest local commerce platform that sees the highest frequency program of its kind when it comes to consumer membership programs. And so I think that will be great for them as well.

하지만 80%에 해당되는 유기적 성장의 기회는 아직 많이 남아 있다.

But again, the 80 for us remains to be building the products. And if you think about it, the runway for just organic growth, for DashPass, or really just for our own customer base is this quite large. I mean we have hundreds of millions of customers who order with us every year, whether it’s on DoorDash or on Wolt and only a fraction of those are members to either DashPass or Wolt+. So we’ve got a long ways to go just within our own ecosystem.

아직도 외식업에서 비중은 한 자릿수이며, 따라서 가장 중요한 것은 제품을 개선하여 이용자수, 가입 회원수를 늘리는 것이다.

And then when you look at this from the consumer’s perspective, although we’ve done a reasonably good job in terms of enabling local commerce in the categories that we play in today, we still only represent single-digit fraction of the restaurant industry and a much smaller fraction of that outside of restaurants. So I think there’s a long runway ahead, and the main thing for us continues to be improving our products so that we can be the most useful to customers that they use our products most often, which will give us the privilege of having them as members in our programs.

Shweta Khajuria(Wolfe Research) : 수익성 개선 요인, 목표 배송비 수준(경쟁 목표 기업)

수익성 개선 요소로 광고 성장, 플랫폼 기여도, 비용 효율화를 언급했는데 어떤 요소가 가장 크게 기여하고 있는지?

Thank you so much for taking my questions. Let me try two, please. Ravi, the day rate contributors in the past, you’ve mentioned its ad growth and platform contribution as well as cost line efficiencies. Could you maybe please rank order them in terms of the impact on take rates as you think about maybe near to midterm?

중장기적으로 가게에 가서 사는 것만큼 가격이 싸질 수 있다고 보는지? 아니면 경쟁사 수준이 되는 것이 목표인지?

And then on price parity, either Tony or Ravi, where do you think you want to be when it comes to grocery price parity in the mid-to-long term. Is there a future where it’s going to be the same as in-store prices? Is that the goal? Or is it that you want to be the most competitively priced online grocery delivery platform? Thank you, Tony.

CFO : 24.3Q 광고 성장, Dasher 비용 절감, 다만 제품 개선이 근본적 원인

매출 성장이 총주문매출(Gross Order Value) 성장을 앞지르고 있는 것은 광고 때문이며, 이는 플랫폼 사업이라는 특성 때문에 가능했다.

Hey, Shweta, it’s Ravi. I’ll take the first one on the take rate, right? Let me start by just giving a broader framework around the interplay between revenue and GOV in our business. I mean if you think about revenue, it’s been outpacing the GOV growth in our business. That’s being driven by ads, as you mentioned, it’s been driven by benefits that we get from the commerce platform.

그리고 비용 효율성이 개선될 때마다 수익이 창출되어 매출 성장률이 GOV 성장률을 앞지르게 되었다. 24.3Q에는 광고와 Dasher 비용 절감 효과가 일어났다. 광고는 특별한 변화 없이도 점진적으로 개선된 것이다.

And any time we improve efficiency on the cost line, whether it’s cash or cost or CLR, that drives revenue. So that’s why revenue growth has been outpacing our GOV growth rate. And more specifically, what we saw in the third quarter was two things. One is advertising, and the second one is leverage from Dasher costs. I wouldn’t read into the advertising as something has changed in which we operate the business. We are operating the ad business with the same amount of discipline. It’s growing in a very healthy manner.

DASH는 Dasher 측면에서도 제품 개선으로 인해 비용이 절감된 데 대해 만족하고 있다. 매출이 GOV 성장률을 앞지르겠지만, 좋은 투자 기회를 찾게 되면 유연하게 투자할 것이다.

We’re also very proud of the leverage that we’ve generated on the Dasher side. A lot of that is being driven by the underlying improvements we are making on the product, and we are pretty happy with that. More broadly, when I think about on a go-forward basis, I would expect revenue to continue to outpace GOV growth. But I would not think of it linearly in terms of the same amount every single quarter. So if you think about the operating philosophy for us, when we find good opportunities to invest, we want to invest flexibly up and down the P&L. Sometimes those opportunities are going to present themselves in the revenue line. And we’re pretty happy to take advantage of that.

CEO : 현재는 정확히 원하는 상품 제공이 더 중요

이용자들은 가격만 보지 않을 것이다.

현재 식료품 사업의 문제는 이용자가 원한 상품을 정확히 받지 못했는데도 추가 요금을 내야 한다는 점이다. DASH는 정확한 상품을 제공하는 것을 우선순위로 두고 있다.

Hey, Shweta, it’s Tony. On your question on price parity, I think it’s a good one. I do think though, in the eyes of the consumer, they think about grocery delivery against a few dimensions at the same instance, and it’s not just about price, right? One of the challenges you see in the grocery delivery industry right now is that customers are asked to pay a premium even though they don’t get exactly what they ordered. And that’s one of the key problems that we’re trying to fix here at DoorDash, which is, first and foremost, how do we get customers exactly what they order.

하지만 가격도 중요한 고려 요소이다. DASH는 가능한한 저렴한 가격을 유지하기 위해 소매상들과 협업하고 있으며, 매장 가격 수준으로 제공되고 있는 곳도 있다. 다만, 더 진전을 이룰 수 있다고 생각하며 고객 스스로 사는 것보다 빠른 수준의 편의성 제공도 목표로 하고 있다.

We think that we’re making great strides against that dimension. But there are other dimensions. Price is one of them, and we are working with each one of our retail partners to making sure that we do have prices as competitive and affordable as possible. We do have some partners already there in terms of having or matching in-store prices. But we think that we can do more there. And at the same instance, we have to continue to offer the level of convenience where we can be faster than what a customer can do on their own.

결국 주문한 것을 정확히, 기대한 가격으로 더 빨리 얻는 것이 DASH의 목표이다.

And so I think the combination of those three things of getting people exactly what they ordered at prices that they would expect, certainly faster than they can do it on their own. That’s kind of what we’re going for. It is the combination of those things in which we’re shooting for.

Cameron Lynch(Deepak) : GOV, AOV 성장 원인

경쟁사보다 높았던 24.3Q 19%의 GOV 성장 요인을 상세히 설명해줄 수 있는지? 또한 평균 주문액(AOV : Average Order Value)이 증가하는데 이는 상품 구성 변화 때문인지 아니면 인플레이션 때문인지?

This is Cameron Lynch [ph] on for Deepak. Just two quick questions. First, can you help us unpack the 19% GOV growth we saw this quarter, a high level between core restaurant and other categories such as grocery, either qualitatively or quantitatively? And second, we saw that AOV trends were up slightly this quarter. Is this due to product mix or bed new price inflation. I would appreciate any additional color you can provide on what’s driving this dynamic? Thanks.

CEO : 선택권, 품질, 경제성에 집중하여 이용자, 주문빈도 증가, 외식, 식료품, 해외 부문 모두 성장중, AOV는 식료품 성장이 기여

DASH에게 가장 중요한것은 이용자 추이이다.

Hey, Cameron. I’ll take both of those. I mean look, I mean, we’re really pleased with the performance of the business on the growth side. So let me talk about the inputs, and then I’ll talk a little bit about the outputs and the various drivers in the business. From an underlying input perspective, right, I mean, the biggest thing for us is looking at the underlying cohorts.

이용자가 두자릿수로 증가하고 주문빈도도 지속 상승하여 모두 사상 최고치를 경신했고, 이는 DASH가 선택권, 품질, 경제성 측면에서 달성한 성과에 따른 것이다.

I answered the question to Mike, I talked about the fact that the cohorts continue to remain very strong. If I look at users, users are still growing at a double-digit rate. Users hit an all-time high in the quarter. Order frequency continues to be at an all-time high. A lot of that is being driven by the underlying work we’ve done, whether it’s selection, quality or affordability. All this has set us up well, not just for the third quarter, but going forward as well.

외식 사업은 안정적인 성장 추이이며, 식료품, 해외 사업 모두 외식사업보다 빠르게 성장중이다.

And from an output perspective, if you think about the various lines of business, the restaurant business, the growth has actually been very stable for the last few quarters. Both grocery new verticals, international they’re growing much faster than the restaurant business as well as they have gained share across grocery as well as most of the international markets that we’ve operated in.

평균 주문액은 식료품 분야 성장이 크게 기여했다. 하지만 DASH가 가장 중요하게 생각하는 것은 이용자수와 이용 카테고리의 다양성이 증가하는 것이며, 매 분기 지속적으로 성장하고 있다.

And to your second point around the overall AOV increase, we’ve seen some increase in the overall grocery business. Again, I wouldn’t think of that as a major shift. Our goal is to ensure that we are bringing the highest number of consumers to order from more categories and the consumers ordering for more categories, that number continues to increase every single quarter.

Andrew Boone(JMP) : GPM 증가 배경, 해외 확장 계획

GPM 서프라이즈가 나온 배경은?

Thanks so much for taking my questions. Ravi, I wanted to ask about the gross profit margin outperformance in the quarter. I understood the call out on the insurance benefit, but is there anything else that you guys want to highlight in terms of the outperformance there?

Wolt가 유럽의 Tazz를 인수했는데 앞으로 어떤 국가의 어떤 기업들을 인수할 계획인지?

And then Wolt acquired Tazz in Europe. Tony, can you just step back and talk about what may be attractive in terms of M&A targets going forward, and why that specific country and acquisition? Thanks so much.

CFO : 물류비 효율성 개선, 재투자, 광고, 규제비용이 감소한 결과이나 특정 GPM 수준을 목표로 하지 않고 장기 이익 극대화를 추구

연초 예상보다 DASH 팀이 잘 해냈으며 효율성 증가, 재투자로 인해 가능했다.

Yes, Andrew. I’ll take the first one on the gross profit. Let me give you two ways to think about this. If you think of the business as a collection of businesses, what you’re seeing is, I mean, we performed really well. The team has executed really well compared to the plan that we have set for ourselves at the beginning of the year. We’ve driven efficiencies in some parts of the business. We’ve reinvested that in other parts of the business, and the output is what you’re seeing on part of the face of the P&L.

광고가 GPM 증가에 크게 기여했다. 또한 규제비용이 지속 감소하고 있다. 그리고 물류비 효율성도 개선되고 있다. 하지만 DASH는 특정 GPM을 목표로 사업을 운영하고 있지 않다.

More specifically, if you think about the drivers, advertising has obviously been a driver in terms of gross margin improvement. The second thing I would call out, Andrew, is we’ve talked about the fact that regulatory costs will continue to reduce as we go through the year. That’s been another driver. And the last one is efficiency from an overall logistics perspective. But the key thing that I would underscore is — remember, I mean, we are not operating the business towards a specific gross margin percentage.

DASH는 장기적 관점에서 이익을 극대화하려고 한다. 이를 위해 모든 분야에서 효율성을 높여 이를 재투자할 것이다.

What we’re trying to do is maximize overall profit dollars over the long-term. And the way we do that is every dollar of efficiency we find, we’re going to reimburse that back in the business. And our goal is to flexibly invest that up and down the P&L, wherever we see the opportunity. Our goal has always been to build a large business while continuing to be manically focused on unit economics. That’s how we’ve operated, and that’s going to be the same philosophy in which we operate the business going forward as well.

CEO : 지역/상품 확장, DASH 사업과의 보완성, 시너지 등 고려

인수할 때 이 회사가 새로운 지역으로 확장하는데 도움을 주는지, 이용자수나 상품 구성을 성장시킬 것인지, DASH가 스스로 성장하기 어려운 분야에서 성장을 가져다줄 수 있을지 고려한다.

Hey Andrew, it’s Tony. On the second question with regards to international M&A. Our standards and VAR continue to remain really high and we are consistent in our approach, which really first and foremost, starts with asking ourselves the question, does this candidate help us launch a new geography, grow our TAM and/or our product portfolio. The second question we ask is, does this help accelerate us in a differentiated way that we couldn’t do ourselves organically.

장기적인 현금 흐름과 DASH의 경영 인력으로 해당 기업의 기회를 잡을 수 있는지도 중요하다.

Three is, do we believe that by partnering with the candidate that we can achieve long-term cash flows. And the last one, perhaps the most important is do we have a team that has the management talent and bandwidth to execute on the opportunity in a single-threaded way. And when I look at that last one in particular, I mean, Wolt [ph] has been on an incredible run. I mean, ever since well, ever since founding, I mean, actually, I should say that it’s now been 10 years for Wolt, actually celebrated 10 years earlier this month, and they’ve achieved over $15 billion of sales for merchants in their lifetime and $3 billion of earnings for years, and they’ve just don’t rate in their geographies, and they continue to take share virtually everywhere they operate in and they’ve continued to help us perform just as a management team.

지난 3년 동안 Wolt는 확장을 지속할 수 있었으며, TAS와 협업할 루마니아 시장도 기대된다.

And so when I look at the performance over the last three years, they certainly have earned the privilege to continue expansion. And then when I piece that together with TAS, playing in an attractive market in Romania, we get really excited about what the combination can provide.

James Lee(Mizuho Securities) : DashMart 현황, 유럽 퀵커머스(15분~1시간 만에 즉시배송) 시장 평가

DashMart가 잘 하고 있는 분야와 개선중인 분야, 성장 제약요인은? 유럽 경쟁사들이 퀵커머스에서 수익성을 확보하고 있는데 유럽 시장의 특수성은?

Great. Thanks for taking my questions. Tony, I was wondering if you can comment about DashMart. And maybe can you give us an update like which business models are working and which business model is still working progress? And maybe talk about some of the growth constraints that we should be thinking about? So — and lastly, it seems like some of the European peers are able to make quick Commerce profitable. Maybe help us understand any differences you’re seeing between North America and Europe. Thanks.

CEO : DashMart는 빠른 재료 조달, 소매업체 유통 사각지대 보완

DashMart는 상인들이 빠르게 재료를 조달할 수 있도록 돕기 위해 만든 것이다.

Sure. On DashMart, we’re very excited about how they progressed. I mean if I rewind the clock when we started DashMart 3, 3.5 years ago, mean the first push was making sure that we can actually be a national service. And one of the reasons for that was really in search of to help merchants actually because we’ve always viewed DashMarts over time as an infrastructure in which we can offer retailers to forward deploy their inventory. But first, we needed to prove to ourselves and then certainly to merchants, that we knew how to run these warehouses.

3년반이 지난 현재 DASH는 좋은 가격에 재고를 정확히, 빠르게 판매하여 그 목표를 달성했다.

And I would say after 3, 3.5 years, the team certainly has achieved that marker. And so that or on their own have done really well in terms of learning how to execute by selling inventory exactly what’s on the shelf, which is very differentiated from a selling inventory that’s available in third-party stores. They’ve done it at great prices, and they’ve done it with awesome selection and very high reliability and speed.

DashMart는 스스로 점유율을 확대하며 성장하고 있다. 또한 다수 소매업체들과 파트너십을 통해 휴무 시간, 침투하지 못한 지역까지 사업을 할 수 있도록 인프라를 제공하고 있다.

And so I think on its own, DashMart have just continued to grow, take share and do really, really well. But that was where DashMarts would end per se. I mean we’ve also seen quite a lot of progress in terms of our partnership discussions with a lot of retailers. So we’ve first started that in Canada and partnering with Loblaws, but we’ve also now have started some of those journeys here in the U.S. as well as in other countries, where we are providing that infrastructure on behalf of retailers so that they can gain additional business at hours that they usually are closed in as well as in geographies that they may not be as penetrated in.

결국 DashMart는 스스로의 성장 뿐만 아니라 소매업체들과 파트너십 측면에서 잠재력이 높다.

So — we’re quite excited about the potential that DashMarts bring both individually, but more so as in partnership with retailers and merchants — and that’s kind of what I expect going forward.

Mark Mahaney(Evercore) : 신제품 피드백, 도시/교외 이용자 차이

24.9월 출시 신제품에 대한 판매자 피드백은? 도시와 교외 DashPass 집중도에 차이가 있는지?

Hey, this is David for Mark. A question on the commerce platform. Do you have any early feedback from merchant customers around the new products that you released last month? And then one more on the Lyft partnership, could you talk about the concentration of DashPass members between urban and suburban markets?

CEO : 지역경제 성장, 디지털 전환 촉진을 통한 큰 시장 내러티브가 중요, 특정 집단을 타게팅하지는 않음

DASH는 1. 지역 경제를 성장시키면서 2. 지역 경제의 디지털 비즈니스 전환을 지원하고 있다. 결국 DASH를 활용하여 상점들은 디지털 역량이 강해지고 있다.

Sure. On the first question with regards to The DoorDash Commerce platform. I mean this announcement for us really, I would say, has been a few years coming, meaning that it really just encapsulates what DoorDash has now become, which is really two parts, right? Part one of our mission has always been to grow the local economy, and we do that by bringing incremental sales with the wrap. And the second part is to empower local economy to become digital businesses. And so a lot of these physical businesses now are using products like DoorDash Drive or storefronts or some of the other products that we’ve talked about in order to become digital powerhouses in their own rights and with their own customers.

DASH 플랫폼에 몇십만 사업자가 입점하여 소비자와 판매자가 연결되고 있어 디지털 역량을 강화하려는 업체들의 입점을 유인하고 있다.

And so — we are seeing that. I mean when you have hundreds of thousands of businesses now who are part of the DoorDash Commerce platform. So I think the numbers speak for themselves in terms of the excitement. And I guess, from their perspective, if you look at DoorDash, the marketplace as the leading local commerce marketplace, where we do the best job of building products that connect consumers to merchants why wouldn’t you want to partner with that and have that for yourself as the retailer that’s trying to become more and more digitally native. And so that’s what we’re seeing.

DASH는 특정 이용자 집단을 타게팅하려 하지 않고, 가장 유용한 제품을 만들어 가입자수를 늘리는데 집중하고 있다.

With respect to — I think your second question about DashPass, I mean we see strength and opportunity in terms of any partnership, whether it’s Lyft or Chase or MAX across all of our members. Otherwise, we wouldn’t be that excited if it was just trying to target one group of customers while excluding a different group of customers. But again, I think it’s important to just understand what the main thing is, 80% of what I believe is important for building membership programs is by building the most useful products, which get used the most often.

다만 Lyft와의 협업은 DASH를 지역적으로 확장하는데 도움을 줄 것이라고 생각한다.

That’s actually how you earn the right to even start a membership program. So that’s the 80%. And then the 20 for us is in partnerships, and we’re super excited about the Lyft partnership as we are about our other partners, and we believe that they’ll help us in any geography.

CFO : 구독자수 1,800만명, 어디에나 존재

DashPass는 지역 상권을 선도하는 구독 사업이며, 성장하고 있다. 3Q 구독자수는 1,800만명을 넘겨 사상 최대치이며, 그들은 도시나 교외나 모든 곳에 있다.

And David, just to add to that, right. Like we don’t — I mean if you think about DashPass, itself, it’s a leading local commerce subscription program, and we continue to grow. In fact, in the third quarter result, we hit a record number of subscribers, which was an all-time high, over 18 million plus DashPass members. They’re everywhere, right? They are not differentiating between urban or suburban. We see strength across the board, which you see in the overall share gains that we’ve had in the quarter as well.

Michael McGovern(Bank of America) : 자율주행, 광고효과

자율주행 활용 계획이 있는지? 파트너십 전략에 포함되는지?

식당 상위노출시 소비자 전환에서 어떤 효과가 있으며, 광고에 미치는 영향은 무엇인지?

Hey guys, thanks for taking my questions. I have two — there’s been a lot of attention on the topic of AVs recently, obviously, for rideshare, but do you have a view on the potential future of the delivery use case for autonomous vehicles? Is that something that you may be looking into for your partnership strategy? And then secondly, on restaurant sponsored listings, what are the latest trends that you’re seeing in terms of merchant ROACE [ph] and consumer conversion? And how is that playing out in terms of demand for the ads? Thank you.

CEO : 자율주행은 Last Mile Delivery 연구중, 시장 성장에 따라 광고효과는 매우 큰 상황

DASH는 17년부터 자율주행에 대해 연구해왔다.

Mike, I can take both of those. On the first question related to autonomy. I mean, we’re very excited. I think it’s been in some ways, as someone who’s been working in the autonomous space now for several years. It’s a long time coming. I think some of the developments that maybe you’ve been reading about or seeing — so maybe that’s where I’ll start which say that we’ve been working on the autonomy delivery problem for several years now dating as far back as 2017.

다만, 마지막 10 피트(Last Mile Delivery) 배송이 상당히 까다롭다

And I think the most important thing to tell you about it after working on it for a while now is that it’s actually quite different from autonomous right halo. And it’s probably obvious to states. But when you don’t have a passenger who can just easily go in and come out of the vehicle, and you have to actually load and unload the vehicle when it comes to item delivery, that last 10 feet is actually quite tricky.

DoorDash 초기 사람들은 우버와 비슷한 서비스라고 생각했었다.

And so it reminds me a lot of actually how DoorDash got started. I think when DoorDash got started 11 years ago, a lot of people thought, oh, you should — this is delivery and something like ride hailing might be similar when it comes to dispatch algorithms or something like that. But if you were to apply the same dispatch algorithm for ride hailing as you did for delivery, you’d almost always make the wrong decision.

하지만 우버와 달리 배달은 음식이 준비되지 않거나 재고가 준비되지 않으면 모두의 시간이 낭비된다. 이 점이 자율주행 택시와 배달에서도 큰 차이라 생각한다. 따라서 DASH는 원칙으로 돌아가 자율주행 기술을 도입하는 것보다 기술을 통해 이 시스템이 잘 작동하도록 만드는 것을 우선시하고 있다.

If you dispatch the closest driver to a passenger, for example, which is what you would do in ride hailing and you apply that to delivery and either the inventory is not available or the food is not ready, then you kind of wasted everyone’s time. And I would say that they are very fundamental differences in a similar way for autonomous delivery versus autonomous ride hailing. And so we’re taking a first principles approach in terms of what we’re building at DoorDash and in terms of marrying technology as well as operations to build a system to make this work.

DASH는 잠재적 파트너와 협의를 많이 하고 있지만 자율주행에 대해 알려진 바와 현실은 매우 다르다.

We’re pretty excited about what we’re working on as well as conversations with potential partners as well. But it’s a very different problem from maybe some of the things that you’ve read and but we’ll have hopefully some things to share in the future, and we’ll tell you more about it then.

시장이 규모를 고려할 때 빠르게 성장하고 있다는 점을 고려할 때 광고효과가 크다.

The second question was around, I think, just adds and just trends in that business. I think more and more of what you’re saying is that you just see kind of a continued progress on that business. And I think it starts from the fact that our marketplace continues to grow at pretty high rates, given its scale.

광고 성장은 시장 성장보다 먼저 온다. 식당의 광고지출에 따른 수익률은 점점 높아지고, 소비자 전환율도 개선되고 있다. 이것이 큰 시장과 결합되면 광고 비즈니스는 빠르게 성장할 것이다.

And I’ve always said that a successful ads business is preceded and always preceded by a successful marketplace business. And so that’s what we continue to see where our ads business continues to have leading ROACE or return on ad spend for advertisers for restaurants and increasingly for retailers. And we see our consumer conversion improving as well where they’re approaching organic rates.

And so I think the combination of these two things in tandem with a marketplace that is the largest for what it does in terms of connecting consumers locally to merchants, that’s why you’re seeing some of the results in terms of the ads business continuing to grow at very high rates at high scale.

Lee Horowitz(Deutsche Bank) : 식료품 광고 수요

식료품 부문에서 급성장하여 시장이 커지고 있으며, 이는 식료품 파트너들의 광고에 대한 관심을 불러일으킬 것이다. 내년도 광고 예산 집행을 고려하면서 DASH에 관심을 표시한 적 있나?

Hi, thanks. Maybe sticking with ads and moving over to CPG advertising. You guys have obviously been stacking multiple quarters of really strong grocery volume growth and getting that marketplace to scale. I guess this is probably presumably grabbing the attention of your CPG advertising partners. Have you gotten any indication from those partners in your conversations as they think about budgets for next year, that they be leaning a bit more aggressively into your platform, just given how much you have grown over the last year or so?

CEO : 성장성, 가맹 식당 매출, 정보, 상품 구성 측면에서 관심

식료품점들은 배달 분야에서 증명한 성장성 뿐만 아니라 가맹점에 식료품을 팔 수 있다는 점, 지역 상권에 대한 가장 많은 정보를 보유하고 있다는 점 때문에도 관심을 많이 보이고 있다.

Yes, I can follow on to the answer to the last question here. I mean the short answer is yes. I mean I think CPG advertisers have always been really excited about us because not only because of our strength in growth outside of restaurants, but also just the combined view that we can offer because you can certainly sell a CPG item across both restaurants and retailers across multiple categories. And by being the largest local commerce player, we get to offer the most data and most views and most shots on goal for every brand to win their fair share. And I think that’s what’s increasing the excitement.

DASH는 상품 포트폴리오를 구성하고 성숙시키는데 능숙하며, 식료품 기업들도 이를 중요하게 생각할 것이다.

On the flip side, I think the team, our team also deserves quite a lot of credit for building and maturing the product portfolio, which is still an area of emphasis for both our CPG ad partners as well as our restaurant partners.

Lee Horowitz(Deutsche Bank) : 식료품 경쟁사 대비 강점

수직적 통합을 이룬 자사 배송 파트너들도 존재하는 등 식료품 분야 경쟁이 심한데 DASH가 승자가 될 수 있는 이유는 무엇인지?

Great. Thanks. And maybe one follow-up just on grocery competition holistically. Obviously, it’s very fierce. You have first-party delivery partners who can perhaps lean in on price, given vertical integration. You have other marketplaces that have other verticals that they can monetize on besides grocery and then obviously some focused grocery marketplaces. I guess within that hypercompetitive environment, where do you see as the most defensible sort of characteristics for DoorDash that should allow you guys to come out as one of the key winners in this vertical over a longer period of time.

CEO : 제품 경쟁력 강점을 토대로 이용자 유지, 주문빈도 성장중

최고의 제품을 만드는 것이 DASH가 경쟁에서 이기기 위한 방법이다. 11년전 시작된 미국 배달 시장, 현재의 해외 시장 모두 최고의 제품을 제공하는 것으로부터 이용자와 배송빈도 유지가 시작되었다.

Well, it starts with building the best product. I mean — and I think this is kind of how you get out of any competitive market. I mean if you look at the restaurant delivery industry, that’s how it started 11 years ago, too. And I think that the way that DoorDash has come to its current position in restaurant delivery, whether it’s in the U.S. or whether you look at us outside the U.S. or Wolt outside of the U.S. It starts by building the product that achieves the highest retention and order frequency, which was — which is really a testament that you built the best product. And it allows you to most efficiently grow. So I think, first and foremost, it comes down to product execution.

현재 DASH가 식료품 배달 분야에서도 선두기업으로, 고객의 절반 이상이 식당 외 배달을 주문하고 있다.

And I think you’re seeing that. I mean you’re seeing that where we are now the first place that consumers come to grocery delivery for, if they are a new customer to grocery delivery, that’s also true if you’re just getting something delivered locally outside of restaurants. And so we’re seeing that — it’s always been true for us in restaurants or for several years now, it’s been true where over half of customers that are shopping for restaurant delivery first comes to us for deliveries now outside of restaurants.

DASH는 이용자 유지, 주문빈도 측면에서 강점을 보이고 있으며, 이는 선택권, 품질, 가격, 서비스 개선에 따른 것이다. 이러한 경영상 우선순위에 따라 높은 성장 속도가 유지되고 있다.

It’s approaching that market, too. And so we’re seeing that. We’re seeing strength on the retention and frequency side with every single cohort that continues to increase as we improve our selection, improve our pricing, improve our quality of delivery, improve our service. And I think that the maniacal focus is what allows you to build the compounding advantage over time and allows you to grow at higher rates over multiple years.

CFO : 가맹점들도 DoorDash 기여도 인정

가맹점들도 DoorDash가 매장 매출 성장을 늘리고 있다고 피드백을 주고 있다.

And Lee, just to add to that, right, just on the consumer side, but we get good feedback from the merchant side as well, where merchants that we partner with have said that we’re driving incremental same-store sales growth for them. The quality that we drive to the merchant has also been great. And you see that in the results where, A, we are the fastest growing in the U.S. as well as gaining share. And also from a cohort perspective, right, the retention and order frequency continues to increase.

CEO : 플랫폼 이용자가 많아 높은 광고효과

DASH는 음식 배달 분야 선두기업으로 식료품과 같은 다른 카테고리 광고주들에게 큰 도움이 된다.

Yes. I think the final thing I believe Lee is that like we also just get the most shots on goal. When you think about what gets delivered most often, it’s prepared meals, which is in a different way of saying restaurant delivery. And because we’re the leading player in that space and because we’re also both in terms of size as well as the frequency we just get more at [indiscernible] with these customers, which is very helpful, especially if you’re not in the restaurant category, say, in grocery or other retail categories. And it’s also really helpful for advertisers, too.

John Colantuoni(Jefferies) : Dasher 보상, 주문 확대를 위한 투자 방향

Dasher 인센티브는 어떻게 변하고 있는지?

Great, thanks for squeezing me in here. So I want to start with sales and marketing leverage continues to be a really nice tailwind for EBITDA. Can you peel back the onion and talk a little bit about contribution from driver incentives. And sort of when you think about beyond the near term and look at supply and demand dynamics and your investments in driver experience, how are you thinking about the magnitude of the ongoing contribution to margin expansion from leverage on incentives?

주문량을 늘리기 위해 어떤 방향으로 투자할 것인지?

And second question, just turning to grocery. How important is capturing more of that big basket weekly shop to your long-term profit aspirations in grocery? And what are the capabilities and investments you still need to make to start driving more of those large basket orders? Thanks.

CFO : 제품 개선이 최우선

모든 영업과 마케팅은 제품에서 시작된다.

Yes, John, I’ll start, Tony will be back. On your point around sales and marketing, I mean, look, John, when I think about sales and marketing or any type of operational efficiency that we drive in the business, it always starts with product because ultimately, product drives retention for us, which drives leverage in sales and marketing. If you break that apart, we’ve seen a lot of leverage on Dasher acquisition over the last couple of years.

제품이 개선되면 Dasher가 배달을 더 용이하게 할 수 있고, 더 오래 유지되어 영업 레버리지를 높이게 된다. 또한 이용자 측면에서도 최적화가 잘 이뤄졌기 때문에 레버리지가 발생되고 있다.

A lot of that is being driven by the product improvements that we’ve made. It’s easier for Dashers to onboard. It’s easier for Dashers to get paid, all of that is driving retention of existing Dashers higher, which ultimately drives leverage from a sales and marketing perspective. The second thing I would say is even on the consumer side, the teams have done a pretty good job of optimizing at a channel level. So you’re seeing leverage from a consumer acquisition cost perspective as well.

DASH는 제품을 계속 개선하여 영향력을 높일 것이나 변화의 속도는 조금 느려질 수 있다. 다만 Dasher 인수, 소비자 확보 여부를 고려할 때 레버리지를 높일 기회는 충분하다.

Looking ahead, I mean, I do expect us to continue to improve the product, which ultimately will drive leverage on sales and marketing. But I expect the pace of change to be slightly slower than what we saw in the last couple of years. But overall, when I think about whether it’s Dasher acquisition or consumer acquisition, there’s still opportunity for us to continue to go and drive leverage there.

CEO : 배송비가 가장 낮은 수준이어서 배송이 작아도 지속가능

DASH는 배송, 물류 관련해서 경쟁사 대비 가장 낮은 비용 구조를 갖고 있다.

And John, on the second question with regards to just larger baskets and grocery. I mean, I would all of that for us is really just cherries on top of the cake, meaning that we don’t actually need large baskets to make the math work for grocery. And that’s because we have the lowest cost structure when it comes to delivery and logistics.

DASH는 이용자, 식료품점 모두에게 작은 배송도 효율적으로 할 수 있음을 보여주었다.

And so one of the things that we’ve been able to do is actually build a very high-growth business with these smaller baskets as a way to introduce ourselves to consumers and grocers alike. And I think it’s actually surprised us just how large that market is. I think in some ways, it resembles almost what happens in Europe, where people instead of buying one large basket for the week, they might buy several smaller baskets for the week. I think that’s a phenomenon that we can afford that others may not be able to.

고객들이 몇 번 구매한 이후 후속 주문들에서는 배송 규모가 커지고 있는데,

규모가 커지지 않더라도 지속가능성은 확보되어 있다.

I think — so anything that we get, and we are getting these larger baskets, especially after customers buy with us a couple of times they start mirroring kind of their habits, where they will buy maybe a couple of smaller baskets during the week and by one large basket on the weekend. So we are seeing that. And we see that with every single subsequent order. We also see that with every subsequent cohort. But it doesn’t have to be a focus for us to make the business financially sustainable.

CFO : 배달 사업에서 이용자, Dasher가 확보되어 수익 기회에 온전히 집중

DASH는 모든 카테고리의 사업을 구축하려고 하고 있으며 플랫폼에 소비자가 이미 있기 때문에 전략적으로 이점이 있다.

John, just to add to that, right, I wouldn’t think of it as a large basket versus a small basket. For us, when we build the business, we’re trying to build the business for all baskets. If you think about it going back to your sales and marketing question, we have a strategic advantage because remember, we already have consumers on the platform.

또한 플랫폼에 Dasher들도 있다. 따라서 (고정비 지출이 필요없기 때문에) 수익성이 높다. 따라서 작은 배송도 수익성을 확보할 수 있으며 수익 기회가 있는지에 온전히 집중할 수 있었다.

We already have Dashers on the platform. So the flow-through from a gross margin to contribution margin for us is very high. When I think about the unit economics, team has done a phenomenal amount of work over the course of the last year. When I look at that in the P&L, that doesn’t concern me. We have a combination of us being able to make the math work at smaller baskets, plus the sales and marketing leverage where we are focused on is what’s the size of the opportunity in terms of scale as well as overall gross profit dollars.

DoorDash 결론 : 자본배치, 성장성, 수익성이 고밸류 만회

(성장성) 소비자, 구독자, 총주문액, 평균주문액 등 지표가 YoY 20% 내외로 성장하고 있으며,

내러티브 측면에서는 해외 시장에서 미국 시장과 유사한 성장 경로를 밟아가고 있고,

식료품 등 다른 카테고리로의 확장도 성공적이다.

(수익성) 질적으로는 이용자수/구독자수를 바탕으로 광고 매출이 확대되면서 수익성이 개선,

네트워크 효과, 규모의 경제가 향후 수익성 개선 논리로, 신규 시장 적자도 상쇄하고 전사적 흑자

(자본배치) ‘소비자에게 제공되는 상품의 품질’이라는 핵심가치를 우선시하여 협업, 인수를 통해 카테고리 확장, 지역 확장을 이뤄나가는 자본배치 방향성이 현재까지 수익성 개선을 견인

(밸류에이션) 현 시총은 $646억(약 87조원)으로 24.3Q $1.62억(약 2,187억원)을 4배(실적 개선추이이므로 보수적 전망이다)했을 때 PER은 100 정도이다.

하지만 네트워크 효과, 규모의 경제 등 강한 경제적 해자의 근거, 성장 내러티브와 매출 성장, 이익 개선 추이를 감안하면 섣불리 고평가로 보기는 어렵다.

가치투자 커뮤니티를 성장시켜나가고 있습니다.

운영 계획과 방향성을 한 번 읽어보시고,

텔레그램을 소통채널로 활용하고 있으니 공감이 가신다면 참여해주세요!

쌍방향 소통을 원하는 분들은 카카오톡 채널로 와 주시면 좋을 거 같습니다.

연말까지 투자 아이디어 대회도 진행하고 있으니 많은 참여 부탁드립니다.